The Polish financial market is developing dynamically, with factoring remaining a key tool for business liquidity. As competition grows and regulations tighten, modern factoring relies increasingly on technology to provide flexible financing. The Polish Factors Association (PZF) plays a central role in this evolution, promoting innovation and best practices by bridging the gap between financial institutions and technology partners.

In today’s sector, simply offering a service is not enough; constant process modernization is essential. Partnerships between industry organizations like PZF and technology providers allow for the rapid testing and adaptation of solutions, ensuring they meet real market needs.

eSourcing: A Strategic Technology Partner As a partner to PZF, eSourcing brings over 30 years of financial market experience (including 16 years specifically in factoring systems) to the table. By combining PZF’s industry insights with eSourcing’s technical expertise, the partnership delivers comprehensive solutions—spanning frontend, backend, and microservices—that accelerate digitalization and improve operational efficiency.

This synergy allows factoring institutions to scale operations, adapt quickly to regulatory changes, and offer a higher standard of service to clients.

Key Technological Solutions:

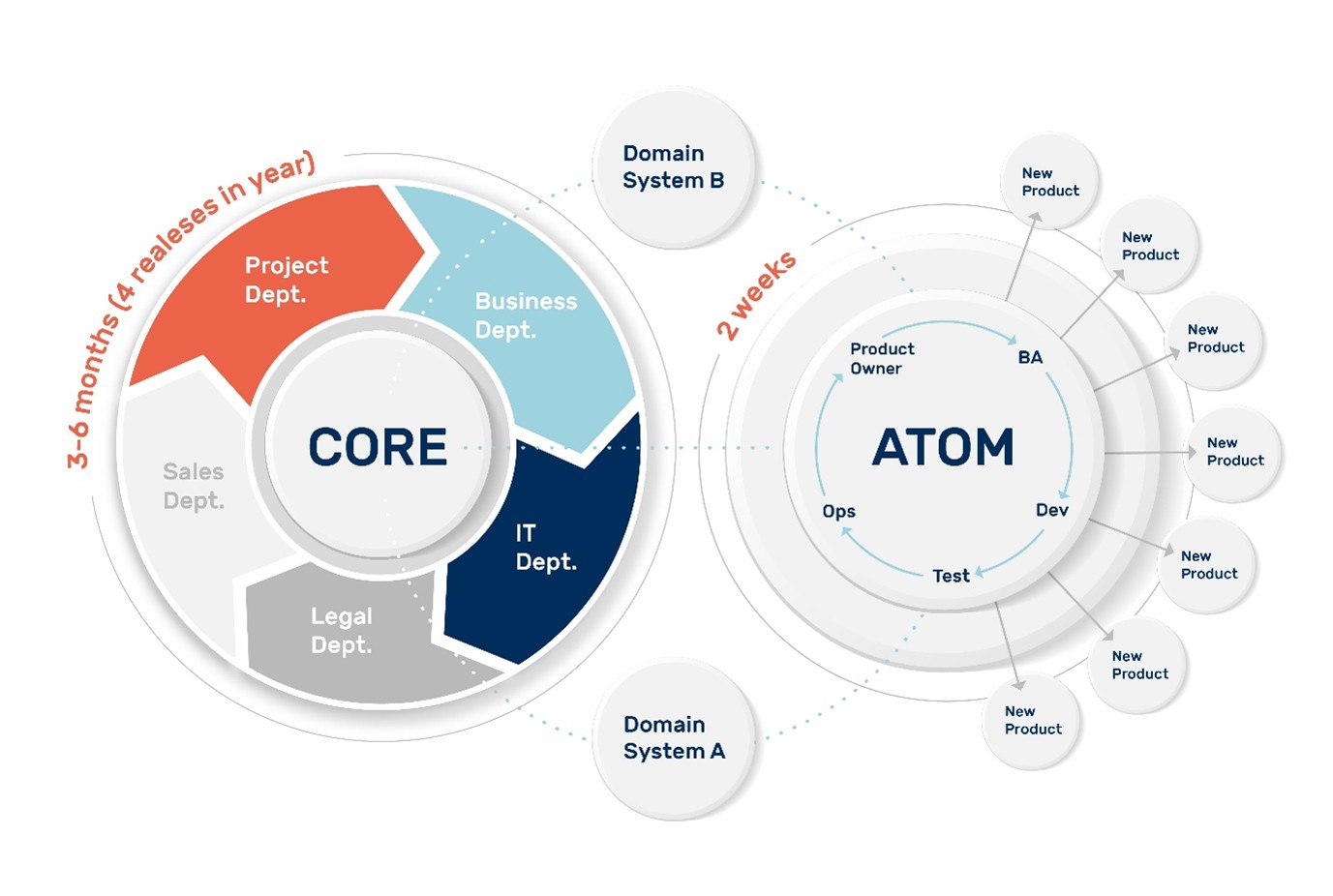

- ATOM (Microservices Platform): A modular architecture that enables the rapid deployment of components such as data warehouses, reporting, and KSeF (National e-Invoicing System) integration. This allows factors to adapt to changes without overhauling their core domain systems.

- OCR & IDP (Intelligent Document Processing): Factoring relies on heavy volumes of unstructured data. IDP automates data extraction and verification, eliminating manual bottlenecks. This reduces errors and operational costs, allowing teams to process applications faster and focus on sales rather than administration.

- AI Solutions (e.g., “DocsBook”): An intelligent guide for documentation that automates repetitive tasks and provides contextual hints. This tool speeds up decision-making, reduces training time for new employees, and minimizes risk, directly translating to better client service.

- Security & Anti-Fraud: Essential for the receivables market, these easy-to-integrate solutions provide real-time transaction verification and pattern recognition to detect and prevent fraud.

Summary In a competitive and highly regulated environment, clients expect fast, digital service. The collaboration between PZF and eSourcing is more than a vendor-client relationship; it is a strategic alliance. PZF shapes the market standards, while eSourcing provides the technological platform that enables the Polish factoring sector to operate faster, safer, and more efficiently.