Leaders who trusted eSourcing

Atom Platform.

We have been providing tailor-made mass efficiency solutions to the European banking sector for almost 30 years. We specialize in the development and outsourcing of proprietary IT solutions supporting the banking sector and the POS payment terminal market. Furthermore, we have the experience, necessary knowledge, and facilities to implement solutions that meet the individual requirements of our clients. One of the 10 largest banks in Europe uses our tools. In Central and Eastern Europe, 13 banks use our solutions for their daily business. We implemented our products in group companies such as Deutsche Bank, Commerzbank, Raiffeisen, Citi, and PKO Bank Polski. Our mass-efficient platform also supports the largest stock exchange in the CEE region, processing more than 30,000 transactions every second.

What makes the Atom Platform unique?

“As the COO of a bank operating in 5 countries, my challenge was to ensure compliance with new EU

regulations and enable my organization to quickly adapt to market requirements.

The current banking system we were using was not sufficiently flexible, and making changes took too much time.

Since replacing it was not an option, we implemented eSourcing’s ATOM to work in parallel with it.

It is highly secure and meets the needs of all parties involved. Our competitive advantage has strengthened as a result.”

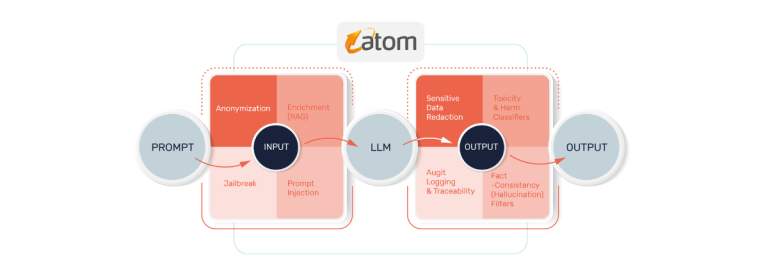

- Protection of data from unauthorized access, tracking of changes

- Extensive logging mechanism on multiple levels

- Mechanism for distribution of log extracts (e.g. via email)

- User authorization and role management based on its own mechanisms, as well as external modules available through WebService

- A maker-checker mechanism that is an integral part of the system

- Secure mechanisms for distributing and updating modules

- Controlled information exchange with other systems (ability to control data integrity, encryption and decryption, generate/check additional checksums, etc.)

- Fast operation, fulfilling all functions under various load conditions

- Adapted for parallel operation (on multiple application servers simultaneously and on multiple database servers simultaneously)

- Modules run on any number of servers

- The system makes sure that servers are loaded evenly

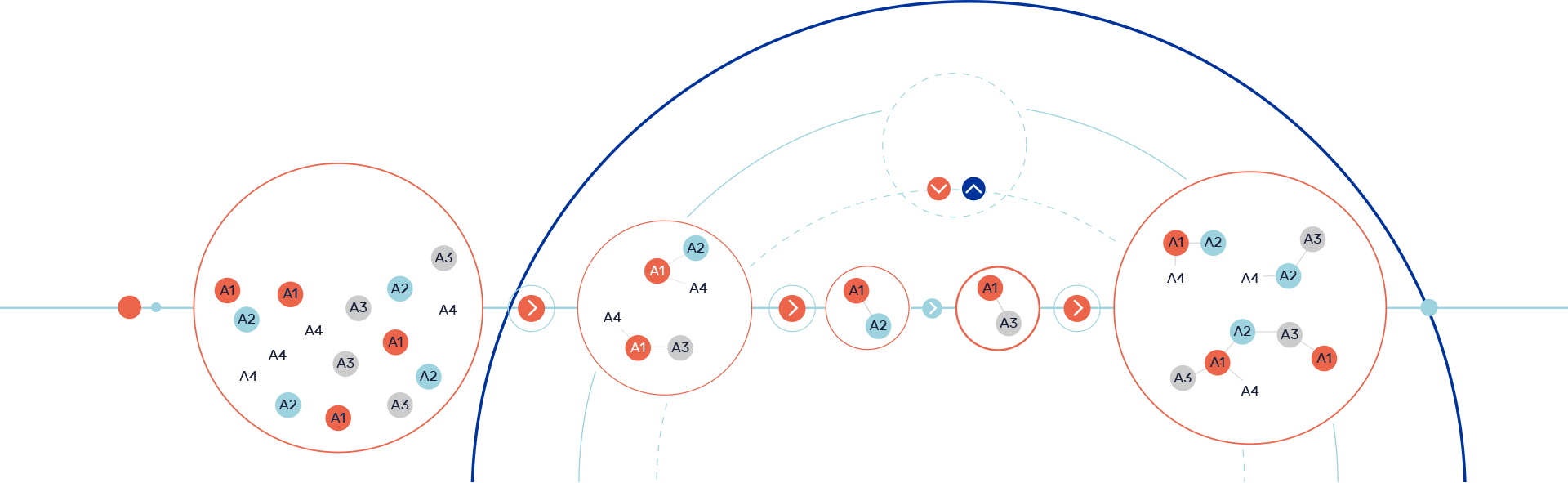

- Ability to easily expand with additional modules without disturbing the system logic

- Atomic philosophy in approach to system expansion with new functionality, modules and channels

- Common foundation allowing to run any number of modules performing simple atomic operations

- Modules are arranged in sequences creating tasks that make up groups of tasks (the number of tasks and atomic operations is unlimited) — the ability to support hundreds of modules independently supporting the most individualized business models of various banking services

- Simplified servicing and reduced downtime

- Simple operation and management

- Extensive parameterization capabilities

- Convenient user interface (configuration and management from one central console, regardless of the number of servers used)

- Configured for unattended operation

- Ability to receive/deliver data through various communication channels and protocols (e.g. SFTP, HTTPS, SMTP, SSL, e-mail, etc.)

- Information exchange via any file interfaces (including files protected by digital signatures, encrypted, compressed)

- Information exchange via SQL database (calling stored procedures, direct database access)

- Information exchange through SOA architecture

Benefits of the Atom Platform

We understand that the changing business environment, demanding customers, and fintechs force us to quickly seize market opportunities. In rapidly emerging blue ocean scenarios, speed is crucial. With hundreds of implementations across nearly every banking area, we have developed an exceptionally fast and agile software development model. Once the platform is installed, the development of individual micro-services often takes less than a week. On average, our implementations are 60% faster than those of our competitors.

As experts in banking software development, we understand the importance of approaching IT changes with careful consideration, especially regarding seemingly hidden dependencies. Unlike our competitors, our organization’s DNA is rooted in integrating with legacy systems firmly embedded within organizations. We recognize that smart evolution of the core banking environment is often superior to revolution, and thus, we possess extensive experience in integrating disparate data sources to ensure seamless support for critical processes.

Security has always been an important factor in our collaboration with the financial sector. Some of our Atom Platform implementations support critical processes within banks. Therefore, Atom meets all the strict cybersecurity requirements set by regulators. For several years now, eSourcing S.A. has diligently complied with the EBA’s stringent regulations on reporting, data security, business continuity plans, and more, ensuring the highest level of service provision.

Our experts also analyze areas related to NIS 2, the Critical Entity Resilience Directive, the Cyber Resilience Act, the Cyber Security Act, and the Digital Operational Resilience Regulation (DORA).

- Code optimization: Our processing modules have undergone continuous optimization over many years to achieve the highest possible processing speed.

- Optimization of communication protocols: Through extensive studies in data transfer, we employ the most efficient and fastest data transfer mechanisms available.

- Processing optimization: This involves utilizing 100% of the physical machine’s capacity.

- Implementation of Atom database solutions: We particularly focus on partitioning the entire database rather than individual tables.

The modular design of the Atom Platform enables selective implementation of essential functions as needed.

This approach substantially lowers costs, encompassing

implementation, technical support, and licensing expenses, while facilitating continuous, incremental development aligned with your strategic and budgetary objectives.

On average, our TCO is 52% lower compared to our competitors.

Solutions.

Applications of the Atom Platform.

-

ESEF

-

ISO 20022

xml reports / MT940 / PDF statement -

Report Factory

-

CESOP

-

Direct Debit

mandate processing -

e-invoicing HUB

-

Direct Debit

order processing -

VoP

-

Payment-HUB

-

Covenant monitor

-

Cash pool reports virtual/real

-

Virtual Account

- reports

Purpose / Problem.

According to the latest EU guidelines, all financial reporting for banks is to be reduced to a single standard called ESEF based on XBRL files. Quick and efficient adaptation of the banking ecosystem to the legislative requirements is a challenge for the whole sector of banking players.

Solution / Benefits.

We have been working for leading players in the banking sector for nearly 30 years, and we know very well that failure to bring the banking ecosystem into compliance with legislative requirements within a certain timeframe carries serious business risks and comes with powerful penalties.

Why it's worth it.

We implemented a solution for a new form of ESEF reporting that is integrated with the bank’s core system in an incredibly fast way. Our clients no longer have dependence on a single IT solution provider and, importantly, reduce the threat of penalization by regulatory institutions. In addition, automating the process significantly reduces the risk of making mistakes in reporting data.

Purpose / Problem.

Banks entering new markets or opening up to new customer segments face the challenge of translating operations performed in the core banking system into other languages and creating new forms of statements (camt, MT940, PDF, etc.), which often takes a very long time and impairs time-to-market business.

Solution / Benefits.

We have created a proprietary solution that flexibly and quickly translates business requirements and goals into an efficiently implemented IT project. Customers no longer suffer from the bank’s high corporate inertia, while business initiatives are supported by efficiently implemented system functionalities.

Why it's worth it.

The implementation based on ATOM Platform by eSourcing made it possible to prepare the bank’s environment in 2 months instead of 18 (as a standard waiting time for a change in the core system). If the Bank wanted to follow new customer requirements based only on the core banking system, then unfortunately the process would similarly count in months instead of weeks.

Purpose / Problem.

Generating information from distributed data and then delivering it to relevant bank customers in a timely manner is a market advantage factor for the banking sector in today’s world. It sounds trivial, but the goal is difficult to achieve and is challenging.

Solution / Benefits.

Atom Platform by eSourcing provides friendly dashboards with which you can easily and quickly prepare any report. Generating XML, CSV or XSLX reports has never been so easy. From the interface, the user selects the fields and format of the report and then defines the frequency of reporting. Thanks to Atom Platform, we can also ensure that the data is thoroughly cleaned before we visualize it.

Why it's worth it.

Report Factory is a flexible tool thanks to which the bank, through a user-friendly interface, can create any report in a few tens of minutes instead of programming changes that sometimes take many weeks. Thus, the bank can save more than 90% of the time to prepare individual reports. Time to market shortens by leaps and bounds, creating a competitive advantage.

Purpose / Problem.

In 2024, EU authorities have required payment institutions to monitor all international transactions and report them in the appropriate form of an XML file to the local National Tax Administration. Banks have been challenged to integrate multiple domain systems and/or process millions of transactions stored in a data warehouse.

Solution / Benefits.

Our Atom Platform-based solution has enabled CESOP requirements to be addressed efficiently. The platform allows integrating with various data sources such as a data warehouse. Then through filtering, import the relevant data, validate it with the schema required by the legislature, and communicate bilaterally with the tax administration. A fair amount of operational work has also been eliminated.

Why it's worth it.

Atom Platform by eSourcing can even monitor beyond 200 million payments per quarter. Automating the reporting process to CESOP has proven to be 60% more cost-effective than developing a client-side core banking system, and much safer than developing this in a completely separate way, not to mention handling the process manually (which carries obvious risks).

Purpose / Problem.

Processing direct debit approvals is one of the more cumbersome processes in a bank, requiring the involvement of a corporate client, an OCR/IDP engine and finally the integration of interbank systems. The tasks must be performed flawlessly, quickly and naturally with the highest security standards.

Solution / Benefits.

Atom Platform can integrate with OCR (Optical Character Recognition)/IDP (Intelligent Document Processing) engine and then confirm with the payer’s bank whether the consent is registered.

Why it's worth it.

The work that was previously done by a team of 8 people on the side of one of the leading players in the CEE banking sector is now done by 2 employees overseeing the ATOM eSourcing solution that automates the entire process. Such a significant reduction of FTE in the process (by 75%) allows the bank to consume resources in other profitable areas for the bank, automating what is repetitive and does not require human labour.

Purpose / Problem.

Efficient, intuitive and secure e-invoice management process, including integration with client systems and creation of XML files with client-side business rules. To meet the requirements of legislation and the process of full digitization of invoice workflow in the EU.

Solution / Benefits.

Atom Platform solution by eSourcing provides a HUB for end-to-end e-invoice processing. It provides seamless communication with the Ministry of Finance in a flexible and scalable manner. The HUB integrates with several systems on the side of the issuer and the recipient of e-invoices. It allows for user-friendly handling of the entire flow of e-invoices through convenient dashboards.

Why it's worth it.

Reducing the risk of keeping up with technological changes forced by the legislature is a value in itself. The implementation time of our solution, but more importantly of the following development changes, considering tailored-made processes is shorter by more than 60% on average. Atom can integrate in a completely arbitrary way with various systems on the customer side. Installing such a platform allows shortening the process of obtaining corporate approvals by more than 80%.

Purpose / Problem.

We have recently witnessed the need for MT to MX file transitions resulting from changes in legislation. For many banks, such a situation was a headache because it required significant effort and changes to systems / processes, generating absolutely no additional revenue for the banks.

Solution / Benefits.

We have prepared a turnkey, flexible solution for changing MT files to MX files based on Atom Platform microservices. Thanks to this, eSourcing clients can deal with growing their business, rather than updating communication formats with the billing authority. Leave these types of problems to eSourcing, and your organization’s operations will be legitimate, and you’ll have more time to generate added value for your entire organization.

Why it's worth it.

Banks with the Atom Platform provide themselves with flexibility and short implementation times, independent of the core system provider. The preparation of microservices responsible for converting files to the appropriate format, while adhering to stringent bank security rules, is shortened by more than 60% compared to the development of entirely new solutions. Not to mention the mitigation of the risk of manual file conversion.

Purpose / Problem.

Verification of Payee is part of Regulation (EU) 2024/886 introducing instant payments. It obliges member countries to make available

a service for verifying the account holder with the IBAN number before making a transfer. Communication will take place bilaterally between all participants in the system via an API.

Solution / Benefits.

Our proprietary solution for handling VoP is based on the integration of all the bank’s necessary systems. We then create a highly efficient and secure connection with a local Routing Verification Mechanism. As part of the implementation, we also offer an intuitive interface through which the bank operator can define verification rules for individual customer types.

Why it's worth it.

Purpose / Problem.

Customers in processing instant transfers, where hundreds of thousands of transactions often have to be processed in fractions of seconds, have faced performance problems and consequent time-outs.

Solution / Benefits.

With performance challenges and scalability issues in mind, we created a proprietary Atom Platform and Payment HUB for instant transfers. Our scalable solution allowed one of Europe’s largest banks to integrate a payment gateway with their e-banking systems and perform for each transaction a balance check and query an external system for fraudulent transactions.

Why it's worth it.

We have achieved a production capacity of over 30,000 transactions per second. Growing business will never be a problem for you again. The Atom platform can naturally handle high-volume processes with ultra-short response times.

Purpose / Problem.

Banks in a situation of price competition and low-interest rates faced the problem of optimizing their lending results. One option was to obligate the customer in the loan agreement to use other bank products. These provisions had different wording, referred to multiple products and quantitative thresholds. The issue arose of how to effectively and accurately manage the implementation of these provisions.

Solution / Benefits.

We created a dedicated solution to monitor millions of transactions on hundreds of thousands of customers to be able to quickly and accurately identify non-compliant customers.

Why it's worth it.

The implementation of the solution increased the result per customer by 20% and improved customer relationship management. After implementing the solution, there was no longer a situation of collecting due fees retroactively, which always reflected on the relationship with the client and the professional image of the bank.

Purpose / Problem.

Large corporate clients of banks often expect customized solutions for liquidity and interest income management. Basic banking systems are very frequently unable to meet such demands, let alone in a short period of time.

Solution / Benefits.

The Atom Platform Cash pooling solution by eSourcing allows bank employees to create the most complex structures in just a few hours in a no-code formula. In addition, adding new solutions that require writing code is more than 60% shorter compared to standard delivery of new software.

Why it's worth it.

The need to efficiently address customer requirements, time-to-market, and effectively compete with Fintech companies that are ” biting into the banking business” is why eSourcing competencies are increasingly recognized by leading banks in Europe.

Purpose / Problem.

Comprehensive, efficient and secure handling of inbound and outbound bulk payments based on the virtual account mechanism (verification, validation, routing to internal and external channels, posting, advanced reporting) and handling of direct debit transactions (including integration with the CSM system for consent distribution) are challenges in themselves in today’s world.

Solution / Benefits.

By implementing the Atom Plaftorm solution by eSourcing, we mitigate the risks associated with modifying the bank’s core system and avoid the high cost of regression testing. The Atom platform is independent of the core system, running on microservices. Atom modules are simple to implement and test because they are clearly separated from the rest.

Why it's worth it.

The solution enabled Corporate Banking units to quickly launch new products without affecting the central accounting system. Corporate Banking clients benefited from custom reports and ERP integration. Implementing such a solution centrally would have required costly regression testing and offered less flexibility. Atomic modules are easier and more cost-effective to design, implement, and modify, as they address specific problems with minimal source code, saving significant analysis time.

Customers review.

News.

Partners.

Polish Bank Association

Self-government organization of banks, established in 1991, founded on the Chambers of Commerce Charter.

Banking Technology Forum

A unique platform connecting the banking and technology sectors.

Polish Factors Association

Polish Factors Association was founded in 2001. Currently, among 29 members of the association, 5 represent commercial banks and the next 19 – independent entities specialized in factoring, 3 business partners and 2 honorary members.

Foresight

We specialise in the automation of business processes. We improve and accelerate the operations of companies using advanced technologies. We open new perspectives for growth.

ABBYY

Intelligent automation solutions using artificial intelligence that have been created specifically for businesses, with their specific objectives in mind.

About us.

We are a strong, energetic

team with practical

experience in finance,

banking and IT.

1. experience and competencies

We have been present in the European IT services market since 1995. We specialize in the production and outsourcing of proprietary IT systems supporting the banking sector and the POS payment terminal market.

Furthermore, we have the experience, necessary knowledge and facilities that allow us to implement and operate solutions that meet the individual requirements of our clients. We have unique competencies in the production and implementation of high-performance and mass-capacity systems.

2. professionalism and commitment

Since the beginning of our activity, we have specialized in the implementation of mass throughput systems. These are solutions requiring the processing of particularly large amounts of information in the shortest possible time, dedicated to exceptionally demanding customers. We focus on creating time-optimized solutions, seeing the competitive advantage of modern companies not only in the quality of service of business processes, but also in the speed of access to processed information.

The dynamic growth of the company is due to the professionalism and commitment of our team to customer service and a wide range of clients.

We pay great attention to software performance. Due to our specialization in mass throughput systems, we consider this parameter as fundamental.

3. comprehensiveness of our services

We provide dedicated solutions that address our clients' challenges. We pay great attention to understanding our customers' needs. Everything to design, build and deliver solutions that are the exact answer to their problems. This allows our customers to focus on growing and running their business. We are there to improve their business processes by providing tailored IT solutions. Satisfaction of our customers is key, which is why we care about the quality and comprehensiveness of our solutions and services. We provide our solutions with technical support and system maintenance services. We provide system support services according to the terms of cooperation agreed with the respective client and based on the client's requirements.